Little Known Questions About Best Us Tax Accountant For Expats.

Table of ContentsSome Known Questions About Best Us Tax Accountant For Expats.The 2-Minute Rule for Best Us Tax Accountant For ExpatsThe Best Us Tax Accountant For Expats IdeasRumored Buzz on Best Us Tax Accountant For ExpatsThe Best Guide To Best Us Tax Accountant For Expats

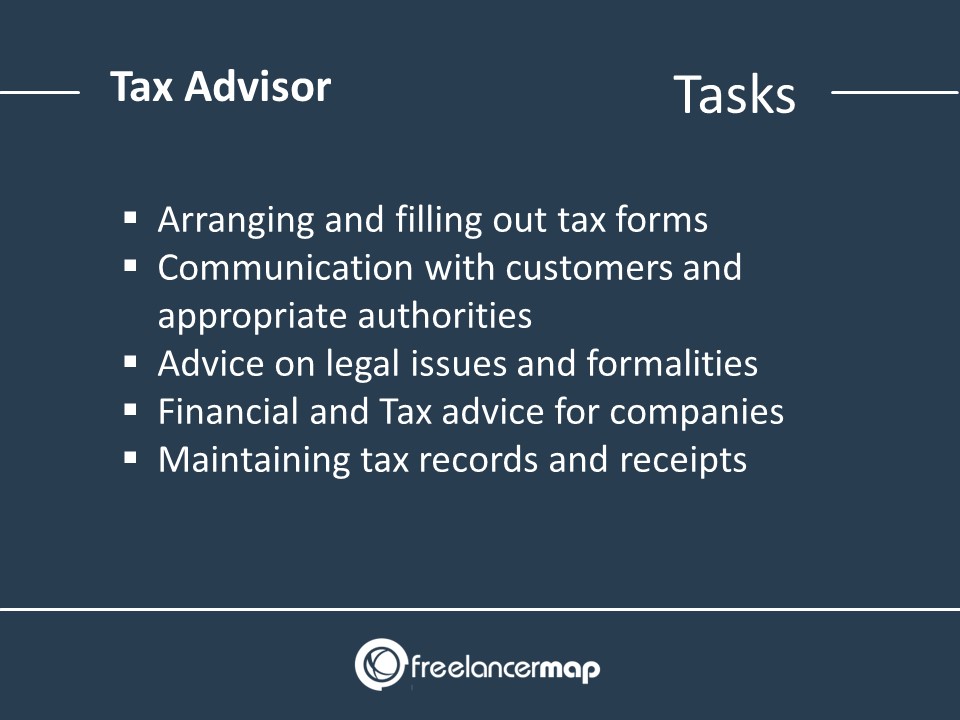

They should be able to communicate complex facts in a simple as well as easy to understand way. They function independently and have a high feeling of responsibility. The tax return is of fantastic significance for private people along with for firms as well as is a crucial consider the monetary situation of those affected.An option: Tax theory, company research studies with an emphasis on tax obligations, finance, bookkeeping or taxation. In enhancement to financial experts, it is above all legal representatives who can acquire the knowledge they need to end up being tax obligation specialists with optional topics in the field of tax law.

The wage of a tax obligation specialist can differ substantially depending on the firm. It also plays a role in whether the revenue comes from being self-employed or having permanent work.

Little Known Questions About Best Us Tax Accountant For Expats.

1. Ask for a Preparer Tax Obligation Identification Number (PTIN)The internal revenue service needs anybody that prepares or assists in preparing government tax returns for settlement to have a PTIN. Keep in mind the phrase "for settlement" volunteer tax preparers do not require PTINs. Make certain your revenue tax preparer puts his/her PTIN number on your return the IRS calls for that, too.

How do you discover the most effective tax preparer near you with the qualifications you want? One means is to search the internal revenue service's directory site. It consists of preparers with PTINs as well as IRS-recognized specialist credentials. Volunteer preparers as well as preparers with just PTINs won't remain in the data source. 3. Look for good friends in high places, Membership in a specialist organization such as the National Organization of Tax Obligation Professionals, the National Association of Enrolled Representatives, the American Institute of Qualified Public Accountants, or the American Academy of Lawyer CPAs is always a good idea to have in a tax advisor, as the majority of have codes of ethics, expert conduct demands as well as various accreditation programs.

Preparers that finish the Annual Filing Period Program can represent clients just in limited situations. Accessibility is also crucial. Even after the filing period mores than and your income tax return is background, the ideal tax obligation preparers will certainly take your phone call, reply to your e-mail, or welcome you for a check out.

Day to day, my role at Pw, C varied greatly relying on the tasks continuous in my team.

The 5-Minute Rule for Best Us Tax Accountant For Expats

There's a distinction between a tax obligation specialist, an accountant, and also a monetary consultant whereby a is managing your financial resources. Also though, an accountant and a monetary consultant can end up being a licensed, however taxes is not always their emphasis part. On the other hand, are extra professionals who concentrate on tax legislation and also financial-related counseling.

If you are somebody that values each penny, employing a could be an extremely reliable choice. Working with a is a terrific advantage for making certain that you are understands all the tax obligation reductions which you are qualified to claim. When you hire a tax expert, they will certainly give you recommendations either over the phone or in-person about your filing options.

If any of the following scenarios use to you, this could be an indicator that you require a specialist to aid you to submit your tax appropriately as well as get the most cash back on your tax return. If so, your tax obligation declaring may be affected.

It is helpful to obtain a's viewpoint of what will be most valuable method given that every pair's situation is various - best us tax accountant for expats. Just Recently Separated Pairs, A consultant can aid you figure out whether it is the very best way to submit separate or together. Generally, it's advised that you file independently so that a single person can't be gone after when the other has any overdue taxes.

Examine This Report on Best Us Tax Accountant For Expats

A will help you arrange through the details as well as see to it you inherent the estate without harassment Have you discovered a blunder on a previous tax return in the past three years? You can function with a tax constant to file an amended navigate to this website return. A can aid you to minimize any damage that may have been created.

Loading your very own tax obligations can be lengthy. A will certainly have the ability to function swiftly and effectively. They will be able to help you to decrease your tension by making certain that your tax obligations are done. If you have an interest in employing a, you ought to hire an expert from a company like L & Co PLT.

is a crucial, necessary as well as completely recommendable service for any type of company or culture, whatever its measurements, tasks or goals, it is a required support for the appropriate performance of these in today's society. The tax expert is not just a source or expert who is made use of in some arbitrary episode or to save costs and also pay much less tax obligations to the State, is a much more complete and also intricate figure, which (best us tax accountant for expats).

Tax obligation recommendations winds up being an excellent financial investment. We speak o when we describe the specialist (or professionals) who is responsible for guaranteeing that a natural or lawful person understands their tax commitments, abide by all that the law requires and depends on day with present guidelines.

Getting The Best Us Tax Accountant For Expats To Work

play an essential function in recognizing the implications of the prices of products as well as solutions between related celebrations, as well as in supplying suggestions on the tax obligation ramifications of operations. To according to the customer's dreams, in order to prepare More about the author the essential sources as well as to be able to arrange the various payments to be made in the coming months.

br/>

Screen and required to ensure that they are finished in time, form and web content. Often times business are not mindful of the opportunities that the State itself supplies them because they just do not know on the issue. for an offered economic activity. A society or business can be limited, confidential, participating, and so on, according to the requirements as well as purposes of the same one.

It hop over to here is just one of the concerns most required by those customers that wish to have quality information on their accountancy by actively checking it. It is a very recommended alternative in SMEs today. The of the employees of a company, society or cooperative can also be accomplished by a tax obligation advisor.